Tax Brackets 2025 Head Of Household Single. See also the standard deduction, personal exemption, alternative minimum tax,. Use this free income tax calculator to project your 2025 federal tax bill or refund based on earnings, age, deductions and credits.

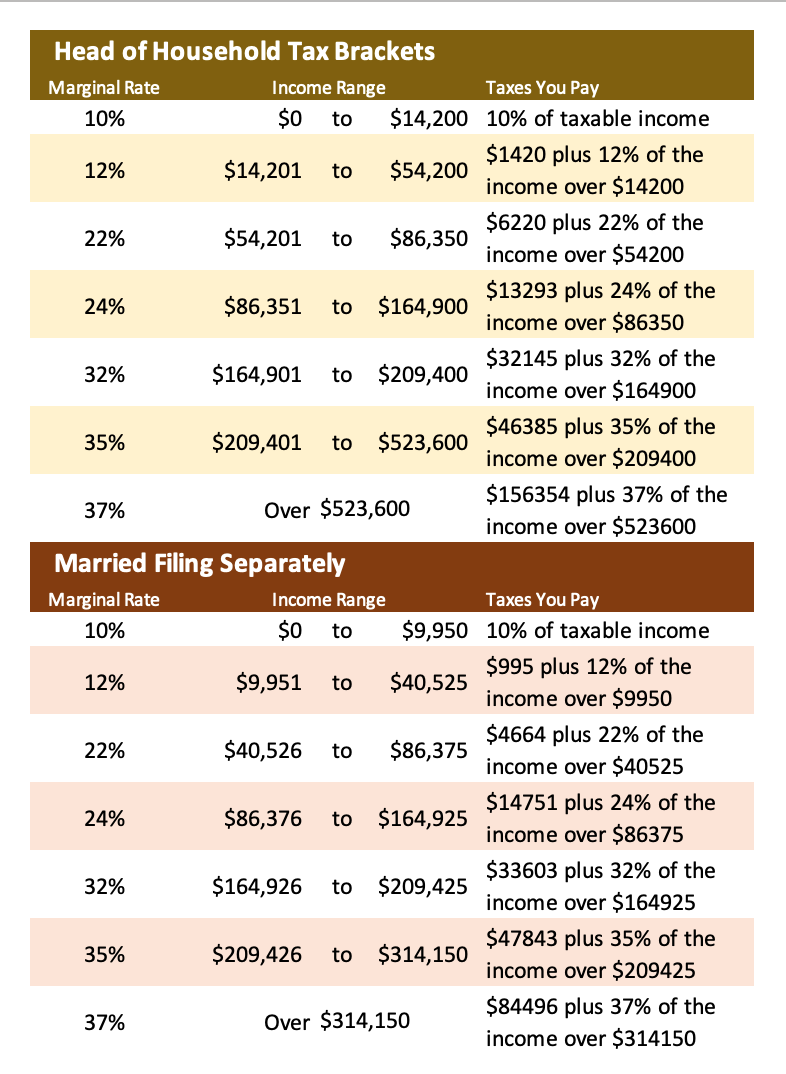

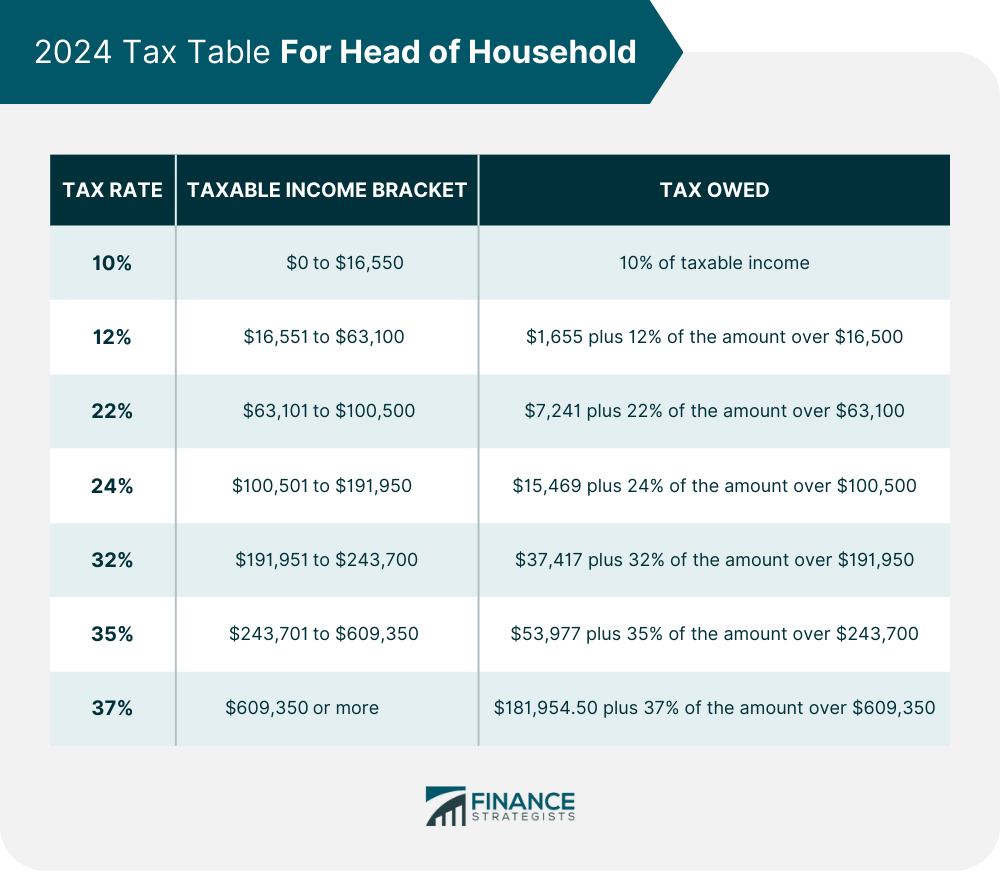

See the current tax rates and brackets for single, married, and other filers. Head of household filers have more generous tax brackets than single or married filing separately.

2025 Tax Tables Married Filing Jointly Single Member Hanny Goldarina, Your bracket depends on your taxable income and filing status.

Tax Brackets For 2025 Head Of Household Single Caye Maxine, Learn the difference between head of household and single filing status, who qualifies for each, and how it affects your tax brackets and deductions.

Tax Rates Heemer Klein & Company, PLLC, Find out how your income falls into different tax brackets and how to lower your tax bill.

Tax Brackets 2025 He … Dinah Carmelia, See the tax tables for single, married, head of household and widower filers, and the payroll deduction requirements.

Tax Brackets 2025 Head Of Household Over 65 Perri Brandise, You can make a partial contribution if your magi.

Tax Brackets For 2025 Head Of Household Calculator Aleen Aurelea, Calculate your federal tax brackets and tax liability for the current or previous tax years.

Head Of Household 2025 Tax Rates Roxi Wendie, Enter your income, filing status, deductions and credits, and see the breakdown of your tax rates.