Prevailing Wage Rates Ny 2025. The information is provided to help employers and unemployed job seekers understand the job titles and wage rates that will determine prevailing wages in local. The office of foreign labor certification has published the latest prevailing wage data from the occupational employment and wage statistics (oews) as.

A private contractor awarded a public contract for the construction or maintenance of a public project in new york state is required to pay employees a. Wage data oflc wage search;

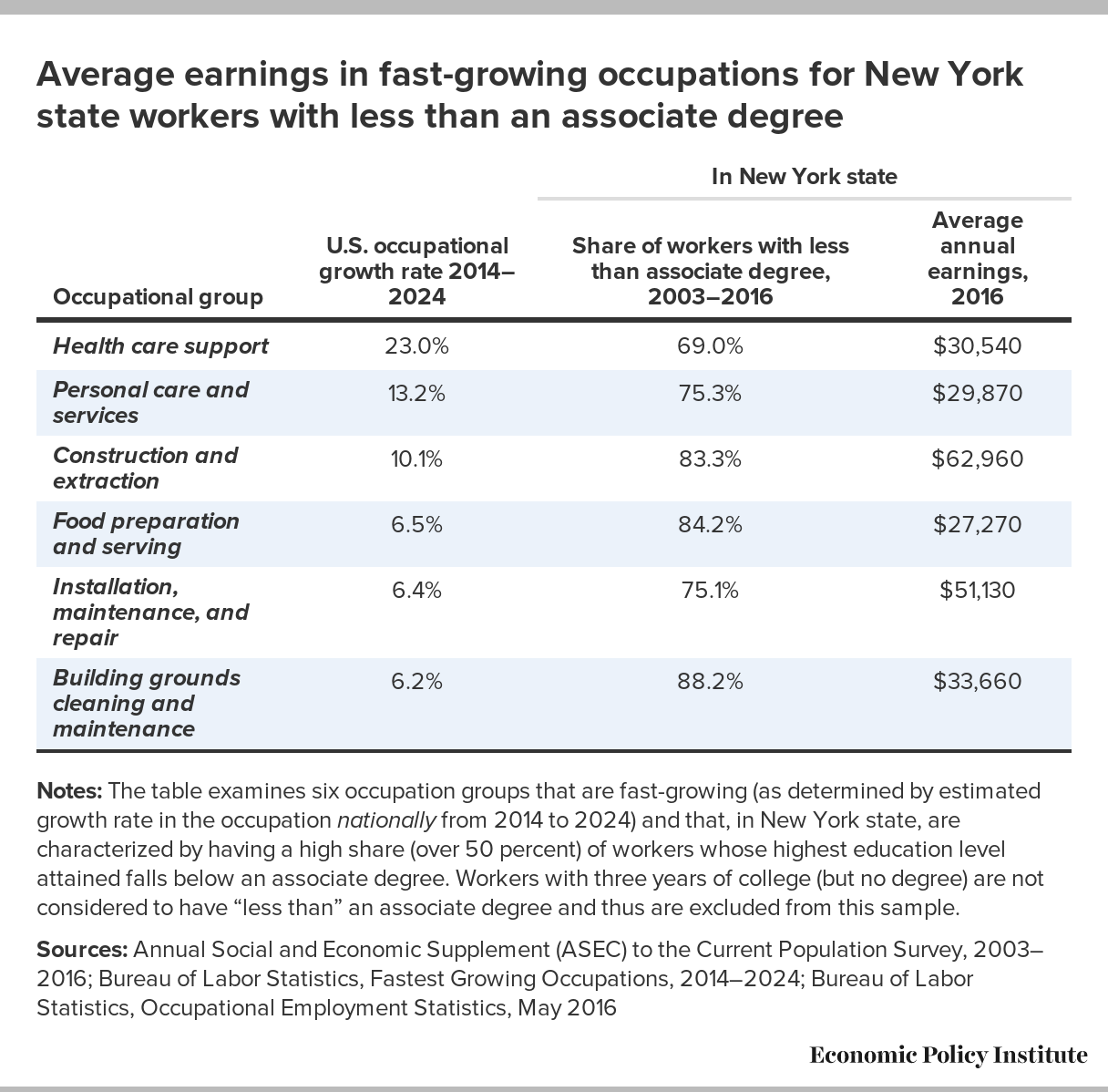

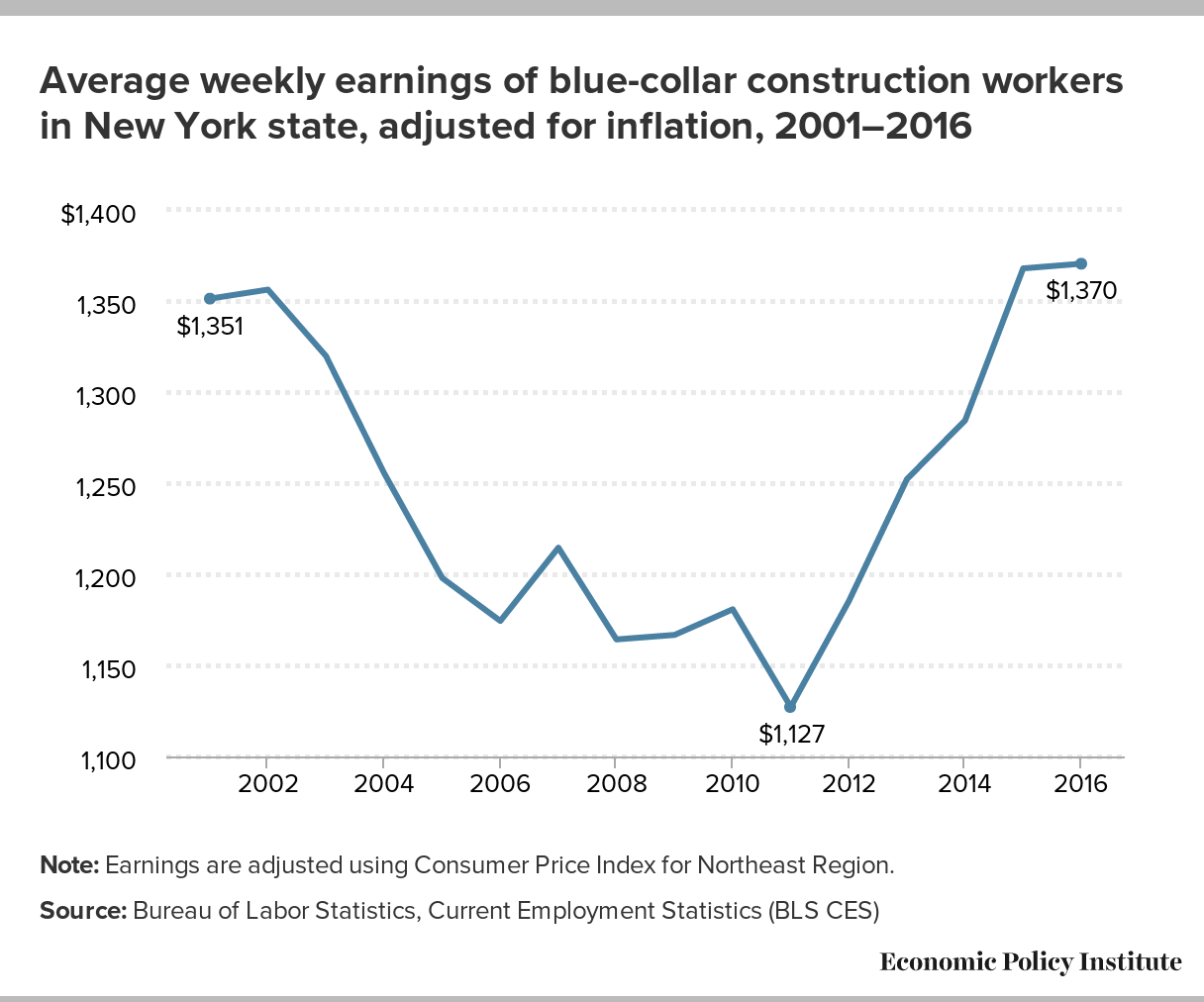

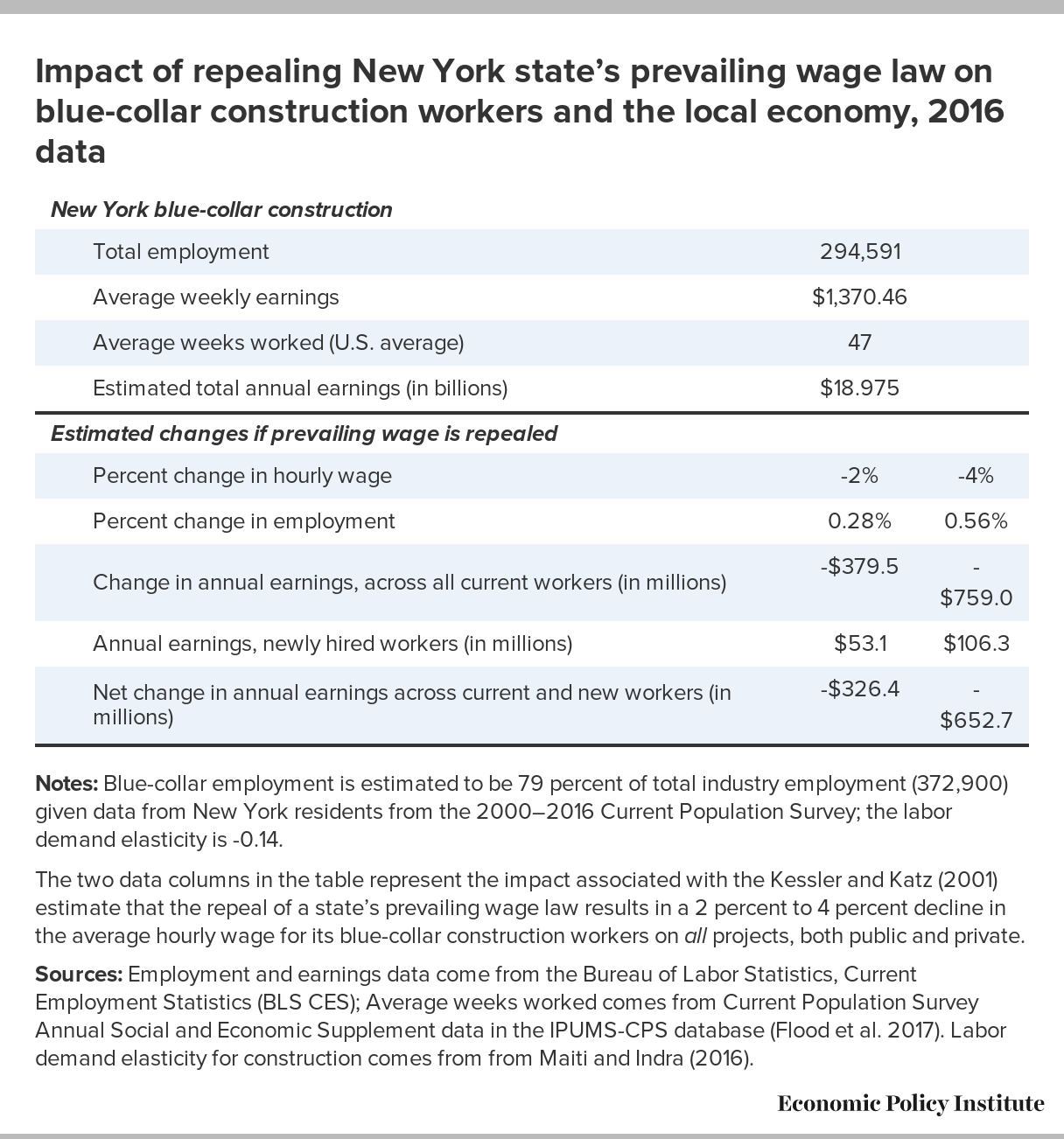

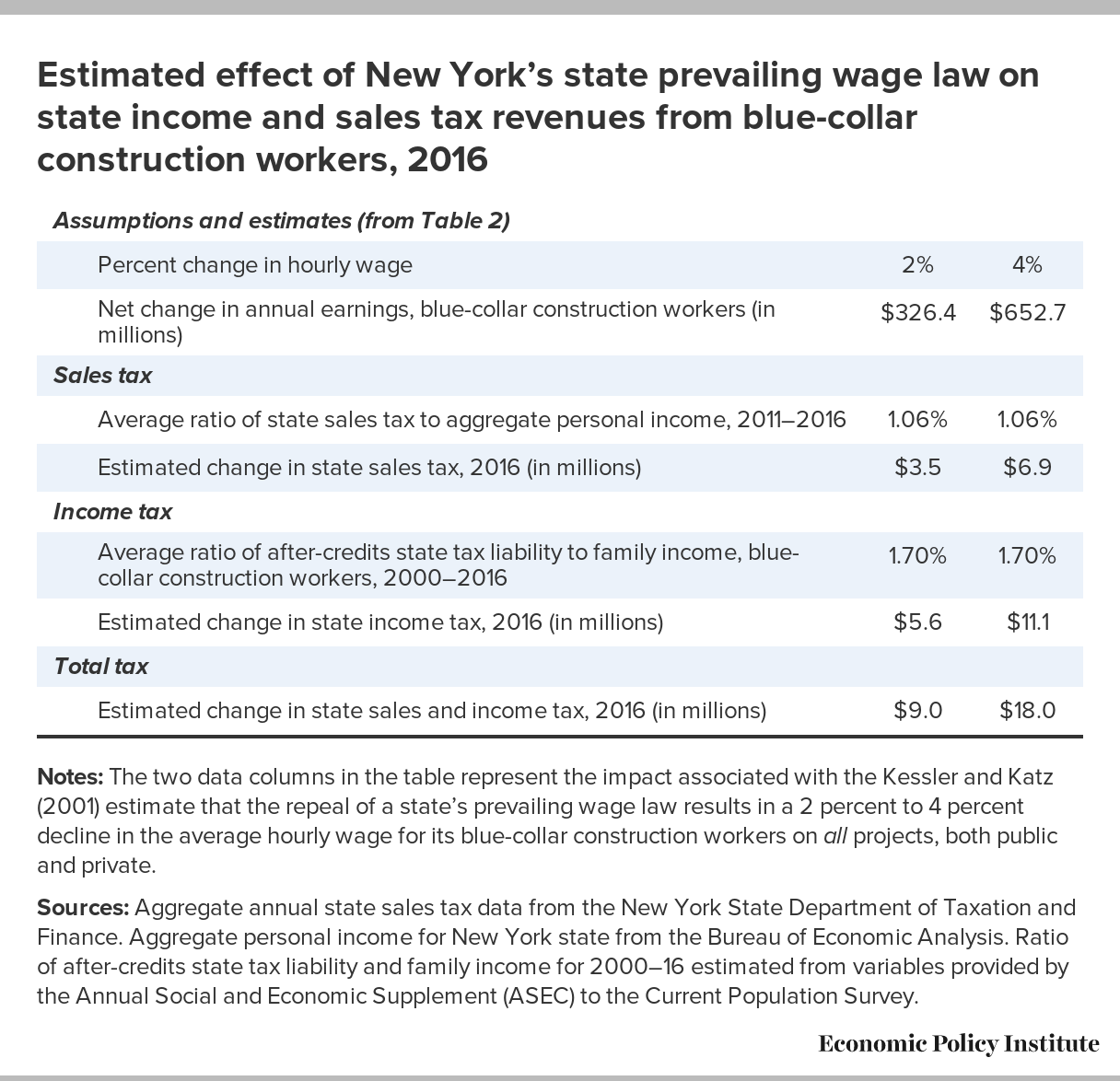

New york prevailing wage law requires contractors to pay construction workers on public construction worksites at hourly rates that are much higher than the.

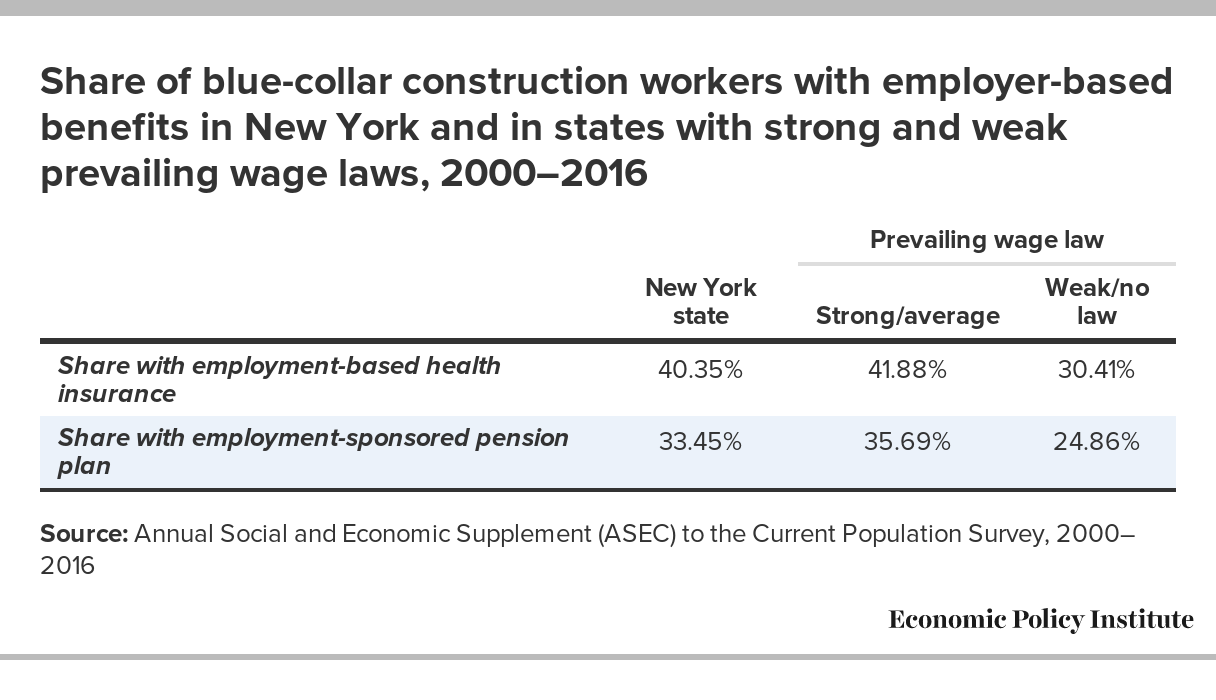

Under new york state prevailing wage law, contractors and subcontractors must pay the prevailing rate of wage and supplements (fringe benefits) to all workers under a public.

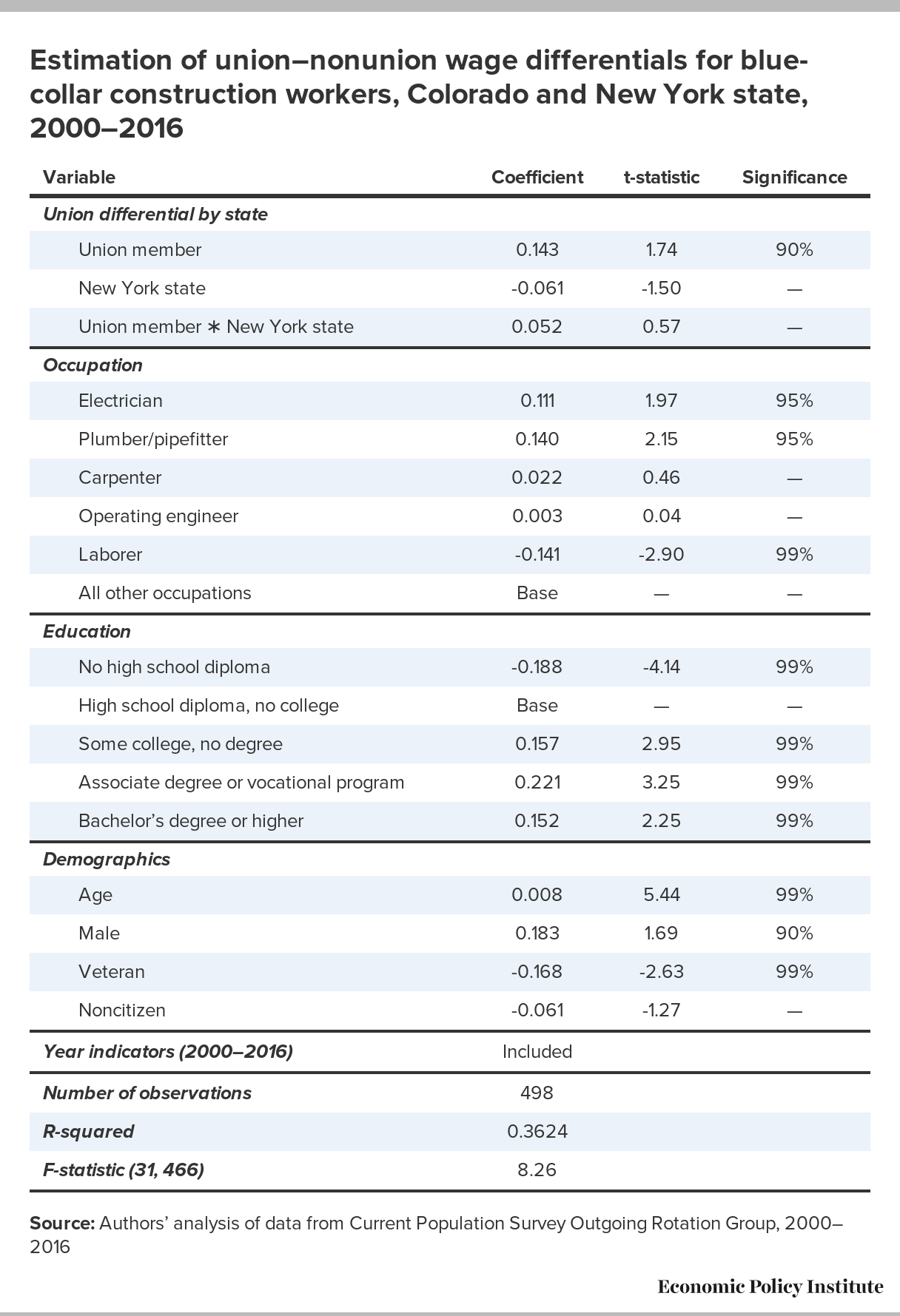

New York’s prevailing wage law A costbenefit analysis Economic, New york's prevailing wage laws in the construction industry are designed to ensure fair compensation for workers by setting wage rates based on union scales and. The information is provided to help employers and unemployed job seekers understand the job titles and wage rates that will determine prevailing wages in local.

New York’s prevailing wage law A costbenefit analysis Economic, The dole said the new wage rates are about 5.7% higher than the prevailing daily minimum wage rates in the region. The commissioner of labor makes an annual determination of the building service rates.

New York’s prevailing wage law A costbenefit analysis Economic, Wage data oflc wage search; The office of foreign labor certification has published the latest prevailing wage data from the occupational employment and wage statistics (oews) as.

New York Payroll & Payroll Taxes Guide Merchant Maverick, The commissioner of labor makes an annual determination of the building service rates. The rate is based on.

New York’s prevailing wage law A costbenefit analysis Economic, New york prevailing wage law requires contractors to pay construction workers on public construction worksites at hourly rates that are much higher than the. Prevailing wage rates in new york can vary depending on the trade and location.

New York’s prevailing wage law A costbenefit analysis Economic, Buildings, heavy & highway, tunnel and. “(the new rates) remain above the latest.

New York City Prevailing Wage Schedules — State and Federal Poster, 58 rows release table for 2025, release tables: In brief, when a project is subject to prevailing wage requirements, workers must be paid set hourly wage rates and hourly benefit amounts as determined by the.

New York’s prevailing wage law A costbenefit analysis Economic, Electric rates for residential customers. In brief, when a project is subject to prevailing wage requirements, workers must be paid set hourly wage rates and hourly benefit amounts as determined by the.

New York’s prevailing wage law A costbenefit analysis Economic, In new york state, the prevailing hourly wage and usual benefits and overtime are paid to most workers, laborers, and. Under new york state prevailing wage law, contractors and subcontractors must pay the prevailing rate of wage and supplements (fringe benefits) to all workers under a public.

Prevailing Waste Empire Center for Public Policy, In brief, when a project is subject to prevailing wage requirements, workers must be paid set hourly wage rates and hourly benefit amounts as determined by the. Employers subject to the fair labor standards act.

The information is provided to help employers and unemployed job seekers understand the job titles and wage rates that will determine prevailing wages in local.