Irs Business Mileage Rate 2025. Every year, the irs sets the standard mileage rate for the upcoming. If the provision expires, the tax brackets will revert to 2017 levels, shifting to 10%, 15%, 25%, 28%, 33%, 35% and 39.6%.

Gov Mileage Rate 2025 Elka Martguerita, The irs calculates the standard mileage rates by conducting an annual study of the fixed and variable costs of operating an automobile.

Irs Mileage Allowance 2025 Adah Linnie, The rising costs of vehicle maintenance and insurance may also contribute to this uptick.

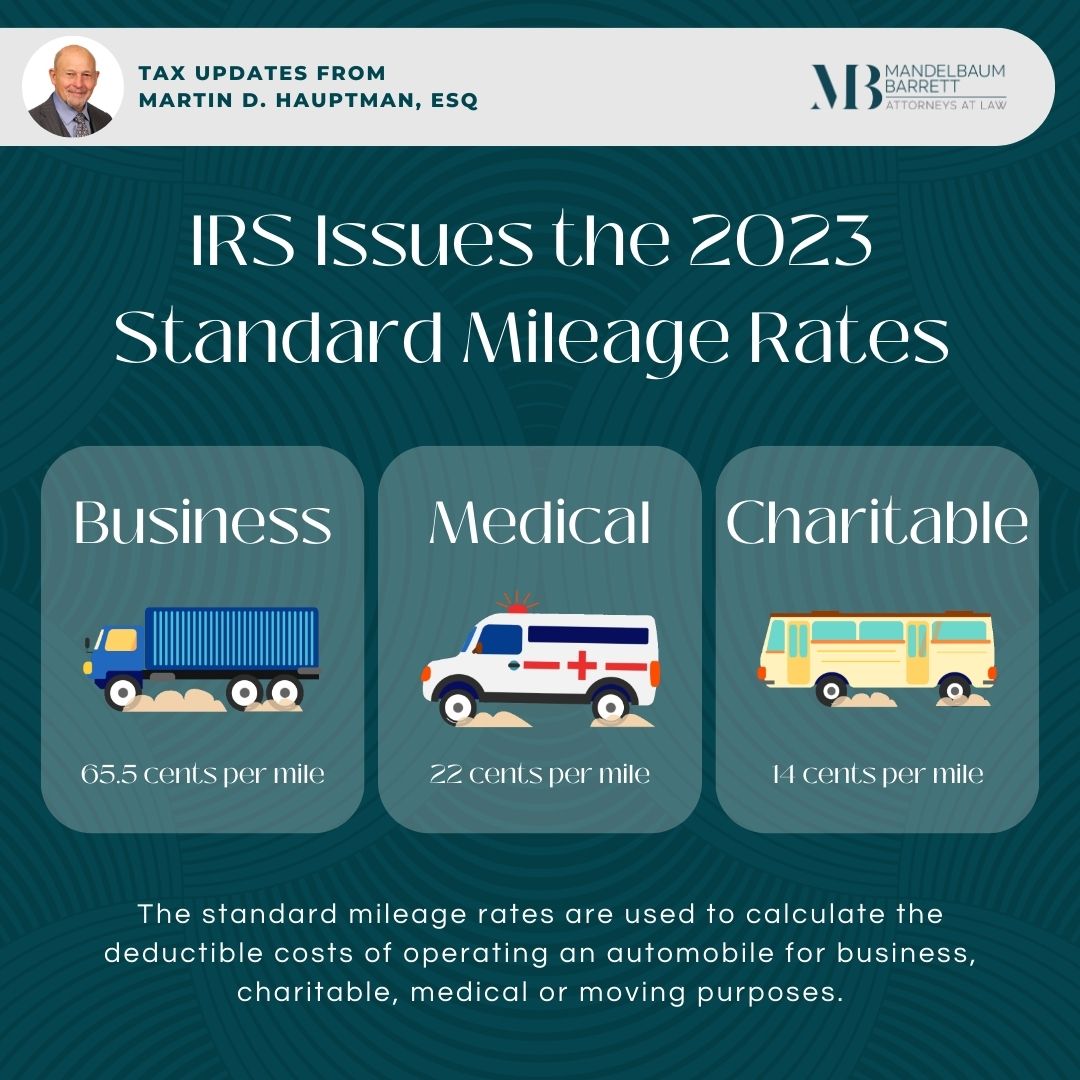

IRS Standard Mileage Rates ExpressMileage, The business mileage rate is the amount the irs allows taxpayers to deduct for each mile driven for business purposes.

Motus on Twitter "What is the IRS mileage rate? What kinds of factors, Shop 2025 ford explorer accessories from the official ford® accessories store.

IRS Increases Business Mileage Rate For 2025, The irs standard mileage rate is a set amount per mile that taxpayers can use to calculate deductions for business, medical, moving, and charitable driving expenses.

Irs Medical Mileage Rate 2025 Rici Verena, The irs standard mileage rate is a set amount per mile that taxpayers can use to calculate deductions for business, medical, moving, and charitable driving expenses.

IRS Issues Standard Mileage Rates for 2025 Mandelbaum Barrett PC, Shop 2025 ford explorer accessories from the official ford® accessories store.

Business Standard Mileage Rate 2025 deedee natala, Shop 2025 ford explorer accessories from the official ford® accessories store.

Standard Mileage Rates Internal Revenue Service Internal revenue, If the provision expires, the tax brackets will revert to 2017 levels, shifting to 10%, 15%, 25%, 28%, 33%, 35% and 39.6%.